FedNow RfP Reject Codes

FedNow® Reject Codes – Real-Time Response Management for Request for Payments (RfP)

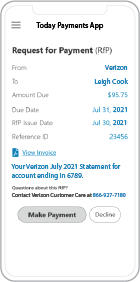

FedNow® Reject Codes allow payees to

quickly identify and resolve issues with real-time Request for

Payments (RfP) submissions using structured ISO 20022

messaging. Whether sending static or variable recurring

payments, these reject codes provide immediate diagnostic

feedback that can be used to update and resubmit the RfP through the

FedNow® or RTP® networks.

FedNow® Reject Codes allow payees to

quickly identify and resolve issues with real-time Request for

Payments (RfP) submissions using structured ISO 20022

messaging. Whether sending static or variable recurring

payments, these reject codes provide immediate diagnostic

feedback that can be used to update and resubmit the RfP through the

FedNow® or RTP® networks.

By using alias-based payment identifiers like

mobile number, email, or SMS, businesses can

streamline the payment lifecycle from RfP initiation to

modification, resolution, and completion—all within real-time

dashboards.

Why FedNow® Reject Codes Matter in the RfP

Process

In real-time payments, speed is everything—but

precision is just as important. When a Request for Payment is

incorrectly formatted or missing required data, it’s rejected

instantly by the payer’s bank or financial institution. FedNow®

Reject Codes provide specific, ISO 20022-compliant messages that

explain exactly what went wrong.

This allows the payee to quickly correct

the issue, repackage the RfP, and re-upload or resubmit the

transaction through a secure dashboard. These codes reduce delays,

eliminate confusion, and improve receivables conversion

rates—especially for recurring billing models.

Key Benefits and Features of FedNow®

Reject Code Integration:

- Real-time reject alerts with structured

ISO 20022 responses

- Modify and resubmit RfPs directly from the

payee dashboard

- Compatible with recurring and one-time RfP

formats

- Alias-based payment routing via SMS,

email, or mobile phone

- FedNow® and RTP® real-time settlement

support

- Excel report downloads for RfP status and

AR aging

- Hosted Payment Page links for seamless

payer re-engagement

- Batch upload tools and customizable

rejection filters

- Free reconciliation and reporting for all

clients

- U.S. financial coverage across all 50

states

Understanding FedNow® Reject Codes in ISO 20022 Format

FedNow® Reject Codes appear in

ISO 20022 return messages and include actionable reasons for

RfP failure. These codes typically arrive

through pain.002 messages and include identifiers that help

merchants modify and resubmit transactions without delay.

Common reject code types

include:

- RJCT:

Rejected due to format or invalid data

- MSGS:

Structural message error in XML or payload

- AC01:

Invalid account or alias data

- AM09:

Invalid amount or currency mismatch

- BE05:

Duplicate or already processed transaction

- MD06:

Missing mandatory data elements

Each reject entry includes a

timestamp, payer alias, MID, and narrative description to

guide payees in quickly fixing and resubmitting the RfP.

How to Modify and Re-Upload

RfPs After a FedNow® Rejection

Rejected RfPs can be

corrected and re-submitted through the payee’s dashboard

without needing to re-author the full file.

After receiving the reject code, simply open the affected

RfP, correct the identified field (e.g., alias, amount,

invoice number), and upload it again using the platform’s

import tools.

This process is fast, secure,

and supports both single and batch submissions for

high-volume payment cycles.

Real-time dashboards allow

you to:

- Sort reject codes by

reason, date, payer, or invoice ID

- Export updated AR aging

reports in Excel format

- Trigger automated

re-submission of corrected RfPs

- Attach Hosted Payment Page

links for payer reattempts

- Integrate with QuickBooks®

and financial ERPs for consistency

To handle FedNow Request for

Payments (RfP) for both "Sent" and "Received" funding in

QuickBooks Online (QBO), including matching, merging,

clearing payments, and addressing reject codes through ISO

20022 messaging, you'll need to follow a carefully planned

process. Here's a step-by-step guide:

1. Integration and

Configuration:

- Ensure that QBO is

integrated with FedNow, allowing for seamless

communication and data synchronization.

- Configure QBO to recognize

and categorize RfP transactions as "Sent" or "Received"

based on the funding direction.

2. RfP Transactions Handling:

- Customize QBO settings to

appropriately categorize and handle both "Sent" and

"Received" RfP transactions.

3. Matching and Merging:

- Implement a robust matching

algorithm to automatically match incoming FedNow

transactions with existing entries in QBO.

- Merge duplicate

transactions to maintain a clean and accurate ledger.

4. Clearing Payments:

- Utilize QBO's clearing

accounts to manage the transition from "undeposited

funds" to specific income accounts.

- Implement clearing

processes to finalize and reconcile each payment.

5. Handling Reject Codes (ISO

20022):

- Establish a system to

capture, interpret, and address reject codes received

via ISO 20022 messaging.

- Create specific categories

or tags in QBO to mark transactions associated with

reject codes.

6. Communication and Alerts:

- Set up alerts or

notifications within QBO to flag transactions with

reject codes for prompt investigation.

- Communicate effectively

with relevant stakeholders to resolve any issues

related to reject codes.

7. Documentation and Record

Keeping:

- Maintain comprehensive

documentation within QBO for each FedNow transaction,

including reject codes and resolution steps.

- Record detailed notes about

the matching and clearing process for audit purposes.

8. Automated Reconciliation:

- Leverage QBO's automated

reconciliation tools to streamline the process.

- Ensure that the

reconciliation process includes validation against ISO

20022 standards.

9. Security Measures:

- Implement robust security

measures within QBO to protect sensitive transaction

data.

- Regularly review and update

access permissions.

10. Compliance Checks:

- Stay informed about ISO

20022 standards and make sure your integration and

processes comply with any updates.

- Conduct periodic compliance

checks to ensure adherence to industry regulations.

Note:

- Continuous Monitoring:

Regularly monitor your integration and reconciliation

processes to identify any discrepancies promptly.

- Training:

Train relevant staff members on the handling of FedNow

transactions, reject codes, and reconciliation

processes.

- Customization:

Depending on your business needs, you may need to

customize QBO settings or seek additional plugins to

enhance functionality.

Always consider consulting with

financial professionals and keeping up-to-date with the

latest features and standards in both QBO and FedNow to

ensure optimal and compliant financial management

processes.

Resubmit Faster, Get Paid

Sooner at

TodayPayments.com

Don’t let rejection delay your

receivables.

✅ Receive instant FedNow® and

RTP® reject codes

✅ Modify and resubmit RfPs with one

click

✅ Upload via ISO 20022 XML or HTML files

✅

Track status and export AR aging reports in Excel

✅

Accept alias-based payments via SMS, mobile, or email

✅

Eliminate banking delays with full real-time reconciliation

tools

Start processing RfPs with

confidence and clarity at

https://www.TodayPayments.com

FedNow® Reject Codes – Diagnose, Fix, Resend, Get Paid.

ACH and both FedNow Instant and Real-Time Payments Request for Payment

ISO 20022 XML Message Versions.

The versions that

NACHA and

The Clearing House Real-Time Payments system for the Response to the Request are pain.013 and pain.014

respectively. Predictability, that the U.S. Federal Reserve, via the

FedNow ® Instant Payments, will also use Request for Payment. The ACH, RTP® and FedNow ® versions are "Credit

Push Payments" instead of "Debit Pull.".

Activation Dynamic RfP Aging and Bank Reconciliation worksheets - only $49 annually

1. Worksheet Automatically Aging for Requests for Payments and Explanations

- Worksheet to determine "Reasons and Rejects Coding" readying for re-sent Payers.

- Use our solution yourself. Stop paying accountant's over $50 an hour. So EASY to USE.

- No "Color Cells to Match Transactions" (You're currently doing this. You won't coloring with our solution).

- One-Sheet for Aging Request for Payments

(Merge, Match and Clear over 100,000 transactions in less than 5 minutes!)

- Batch deposits displaying Bank Statements are not used anymore. Real-time Payments are displayed "by transaction".

- Make sure your Bank displaying "Daily FedNow and Real-time Payments" reporting for "Funds Sent and Received". (These banks have Great Reporting.)

Each day, thousands of businesses around the country are turning their transactions into profit with real-time payment solutions like ours.